Innovation and Resilience Forum

October 16 - 18, 2024

Fairmont Le Château Frontenac, Québec City, QC

2024 is the biggest election year in history, with half of world’s population – 4 billion people across more than 60 world’s economies joining for election.

How do institutional investors manage the economic implications of election year, as well as rapid development of Generative AI and climate change risks, while delivering consistent returns? Join (4th annual) Innovation and Resilience Forum this October in scenic Québec City, interact with leading institutional investors on long-term strategies in an uncertain environment.

Advisory Board

Marc Gauthier

CPA, CMA

University Treasurer and Chief Investment Officer

Concordia University

Christophe L’Ahelec

CFA, MBA

Managing Director, Head of Active Public Markets

University Pension Plan

The Event Experience

Participate in peer-to-peer discussions addressing forward-looking topics facing institutional investors

Network with institutional investors and your peers through a series of breaks and roundtable exchange discussions

Hear from a vast array of industry experts through interactive discussions

Extend connections at the off-site reception and dinner

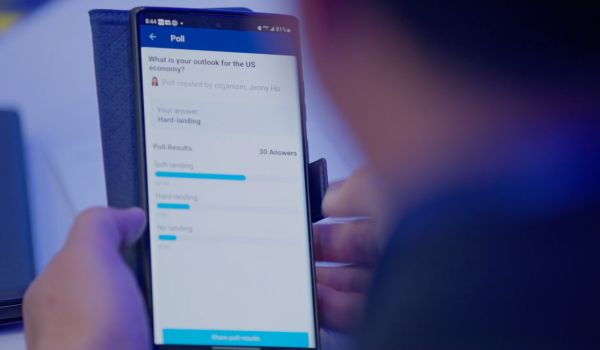

Interact with speakers and make connections through use of an event app